Conversion of big amount of FX and send to your own account should not be a compliace issue, yes?

I have done that in many tranches and did not run into any issues. I suspect the issue may be doing the transfers to third party accounts, rather than to your own account.

I’m guessing if you do too much money shuffling one way or the other they might get cranky. But the tolerance will certainly be higher for transfers to/from yourself.

RECOMMEND ALTERNATIVES TO BIG BANK - IF you do not currently understand Portuguese.

UPDATE - I received confirmation from the Bank Manager at BIG that they do NOT have English web translation and do NOT have an App in English. I am trying to get invested by the end of the year and my only options at the last minute were either BiG or Atlantico (who I understand caters to foreign investors). BiG was chosen by my attorney as being quicker to open an account but had I known of the interface language barrier, might have insisted on Atlantico.

Having said that I feel confident my Bank Manager will try to help me negotiate the site for basic stuff to follow my investment. We will have to investigate alternate bank options to pay bills and for regular banking. Perhaps this may force my earlier learning of Portuguese - "when in Rome … ![]()

Anyone have any thoughts on where to store a few thousand euros for incidental payments and lawyer payments?

I’m considering both Bison and Wise, or just not keeping any extra EUR and converting on demand either via wise or IBKR if they don’t close my account.

Bit tangential to the topic, sorry, if there’s a better thread point me in the right direction!

I’m keeping some of my extra EUR in my Banco Atlantico account, and more in IBKR. I have some USD and EUR in there to convert back and forth a bit as the exchange rates fluctuate.

Garrett,

if you are below their threshold (I don’t remember exact amount maybe 12,000 E) then Wise is a very good choice with no negative interest assessed. You can search in these forums or on Wise site. I posted about this in the past.

Activo is nice. No fees except for customer service. Compatible with all payment terminals, MB WAY, etc. Works fine.

We’ve been dollar cost averaging over the past 6 months transferring $ to € each ~ .01 decrease as part of a LT retirement strategy ( we’re also GVing). 1.1275 for the latest tranche ( ![]() ). We’re now looking at transferring some of the euros from our PT € cash account to Nexo to earn interest (it looks like it could potentially be up to 12%). Be interested if anyone else has already done this.

). We’re now looking at transferring some of the euros from our PT € cash account to Nexo to earn interest (it looks like it could potentially be up to 12%). Be interested if anyone else has already done this.

Matt,

I am not so familiar with Nexo but if you mean to invest in Cryptocurrency and lend your coins, do note that I believe reading that the DOJ and NY AG are investigating some of these companies. You might want to research "ny ag crypto lending nexo’ .

Furthermore, although BTC is a decentralized “digital currency” and can be exchanged for any number of currencies, at least for now in my opinion it still is highly dependent on the fiat currencies. So for a strategy of of converting to Euro and then to crypto, you may be better off investing directly into crypto. It seems inefficient to go from USD - EURO - BTC.

Don’t trust anyone promising 12% denominated in a base currency that isn’t experiencing huge inflation ( no the usd and eur don’t count)

Back on topic for the thread, I was able to submit a sepa transfer request from IBKR shortly after midnight on the settling day (two days after tax date) of my eur conversion. I am glad I didn’t have to wait until the same time of day that I made the conversion order

That said IBKR has been very disappointing with customer service. None of my questions have been answered when I talk to them and they promise to follow up, but don’t

Oh well, cheap conversion I suppose

SOP. Again, this is just not what they do. Indeed, services to retail customers is just not what they do.

Just gives me a good reason to stick with Vanguard for my actual portfolio ![]()

If you have a USAA account or access to getting a USAA Bank account I highly suggest this as a quick and cost-efficient way of wire transfer to a Portuguese Bank. ![]()

I wire transferred $410,000.00 from my USAA account on November 24 and $409,977.28 was received in my BiG Bank USD account on 11/25 - Thanksgiving Day ( a USD to USD transfer loss of $22.82) . I also paid $45 in wire transfer fees ($20 USAA wire fee, $25 NY Mellon Bank fee who is their intermediary bank). So a total transfer charge of $67.82 ![]()

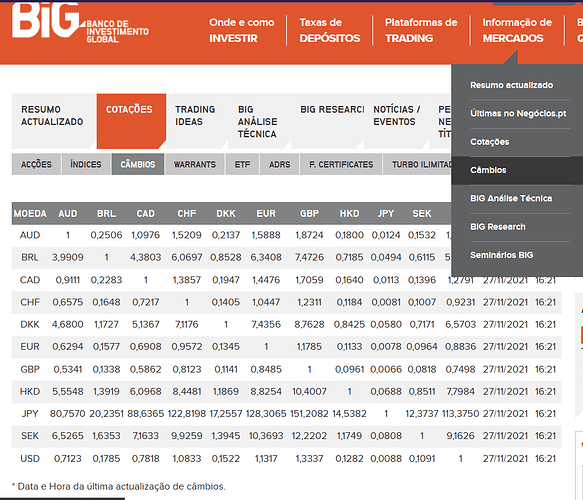

Unfortunately, I did not check my email on TG day when the BiG USD/euro exchange rate was 1.12355 and when I checked this am the rate had increased (1.13135) for a potential conversion loss of about 2500 euros if transferred today, so I will wait until Monday and hope the rate is more favorable.

Roger ![]()

It sounds like you transferred USD to BiG and then BiG made the conversion from USD to EUR? I’m in the process of setting up a BiG account and I didn’t realize the account would accept a USD transfer or convert the funds. Did you have to ask for anything special to make this happen?

Tangential again, but anyone with Bison familiar with how to get money back into your Wise account?

I sent a test 5 dollar SEPA transfer, but Bison’s SEPA form is a bit vague and I guess I did something wrong - I got a message from Wise a bit over a day after sending it saying they were having trouble verifying it was me.

I put in the IBAN as given in my wise account and the BIC (WITH the XXX on the end, should I not do that?) and under description I put the reference number Wise gave me.

Anything I’m doing obviously wrong?

I did exactly that, and was able to move 1 EUR to my Wise account just fine. Have not tried anything larger. I have not tried to move USD however.

Trying again with no xxx at the end of the bic, And added the payment reference to both of the last fields. We’ll see

Mark -

That is correct. After all the forms, KYC call etc, BiG opened a Euro account which became active on my deposit of 2000e (transferred USAA–> Wise → BiG). Once the Euro account was opened with funds, BiG was able to open a USD sub-account into which I was able to direct wire USD from USAA Bank. Upon your request and timing, BiG can convert the USD to Euros at a spread cost of 0.12%. Except for a $45 wire charge at USAA/Mellon Banks, there were no other fees (except for a loss of $22.28 I cannot account for that I’m not sweating. Not bad for a $410k transfer!

Word of Warning- BiG Bank does NOT have English translation on their website and an English app is not available, making it challenging to negotiate. BTW - Google translate will work only on the pages BEFORE you login. The secure BiG bank pages do not work with Google translate. I have been making a spreadsheet to translate the words on various pages (slow process).

You can view the daily BiG conversion rates, by clicking on the selection as shown below

Good Luck. (see also my posts 18,29, 37 above)

Roger ![]()